<!– –>

<!–

–>

<!– –>

<!–

–>

<!–

–>

<!–

–>

<section class="container article-section status_prime_article single-post currentlyInViewport inViewPort" id="news_dtl_105572044" data-article="0" page-title="Rise of the Indian Challengers in the Global Cardiovascular Devices Market" data-href="https://health.economictimes.indiatimes.com/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044" data-msid="105572044" data-news="{"link":"/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044","seolocation":"/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044","seolocationalt":"/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044","seometatitle":false,"seo_meta_description":"The Indian domestic market is now poised for much faster growth compared to its global peers due to its considerably small base versus the size of its population. Deepening insurance penetration, rising affordability and the widening of patient pool driven by government sponsored schemes are some of the key factors driving this growth. ","canonical_url":false,"url_seo":"/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044","category_name":"Medical Devices","category_link":"/news/medical-devices","category_name_seo":"medical-devices","updated_at":"2023-11-29 05:58:33","artexpdate":false,"agency_name":"ETHealthWorld","agency_link":"/agency/88675629/ETHealthWorld","read_duration":"4 min","no_index_no_follow":false,"keywords":[{"id":1832783,"name":"ujjwal singh","type":"General","weightage":80,"keywordseo":"ujjwal-singh","botkeyword":false,"source":"Orion","link":"/tag/ujjwal+singh"},{"id":3727552,"name":"meril life sciences","type":"General","weightage":80,"keywordseo":"meril-life-sciences","botkeyword":false,"source":"Orion","link":"/tag/meril+life+sciences"},{"id":1715229,"name":"smt","type":"General","weightage":50,"keywordseo":"smt","botkeyword":false,"source":"Orion","link":"/tag/smt"},{"id":53564,"name":"southeast asia","type":"General","weightage":50,"keywordseo":"southeast-asia","botkeyword":false,"source":"Orion","link":"/tag/southeast+asia"},{"id":15378315,"name":"Cardiovascular devices","type":"General","weightage":20,"keywordseo":"Cardiovascular-devices","botkeyword":false,"source":"Orion","link":"/tag/cardiovascular+devices"},{"id":1069791,"name":"translumina","type":"General","weightage":20,"keywordseo":"translumina","botkeyword":false,"source":"Orion","link":"/tag/translumina"},{"id":5949510,"name":"percutaneous coronary interventions","type":"General","weightage":20,"keywordseo":"percutaneous-coronary-interventions","botkeyword":false,"source":"Orion","link":"/tag/percutaneous+coronary+interventions"},{"id":1544318,"name":"stent implants","type":"General","weightage":20,"keywordseo":"stent-implants","botkeyword":false,"source":"Orion","link":"/tag/stent+implants"}],"read_industry_leader_count":false,"read_industry_leaders":false,"embeds":[{"title":"Over the last six years, most Indian stent manufacturers have seen exponential growth in international markets and have established a strong foothold in multiple countries.","type":"image","caption":false,"elements":[]}],"thumb_big":"https://etimg.etb2bimg.com/thumb/msid-105572044,imgsize-132670,width-1200,height=765,overlay-ethealth/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market.jpg","thumb_small":"https://etimg.etb2bimg.com/thumb/img-size-132670/105572044.cms?width=150&height=112","time":"2023-11-29 05:58:12","is_live":false,"prime_id":0,"highlights":[],"highlights_html":"","also_read_available":false,"body":"

by Ujjwal Singh

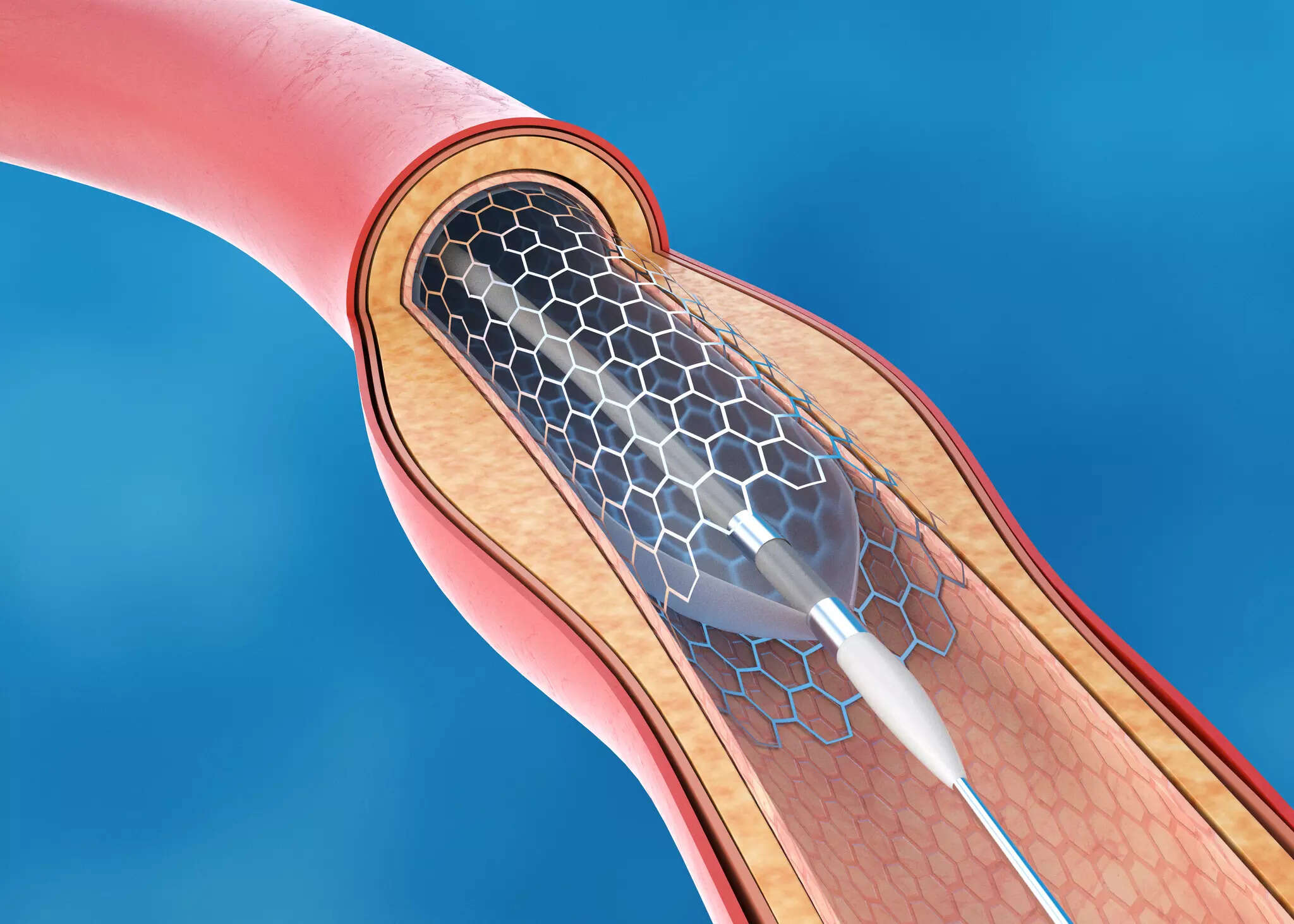

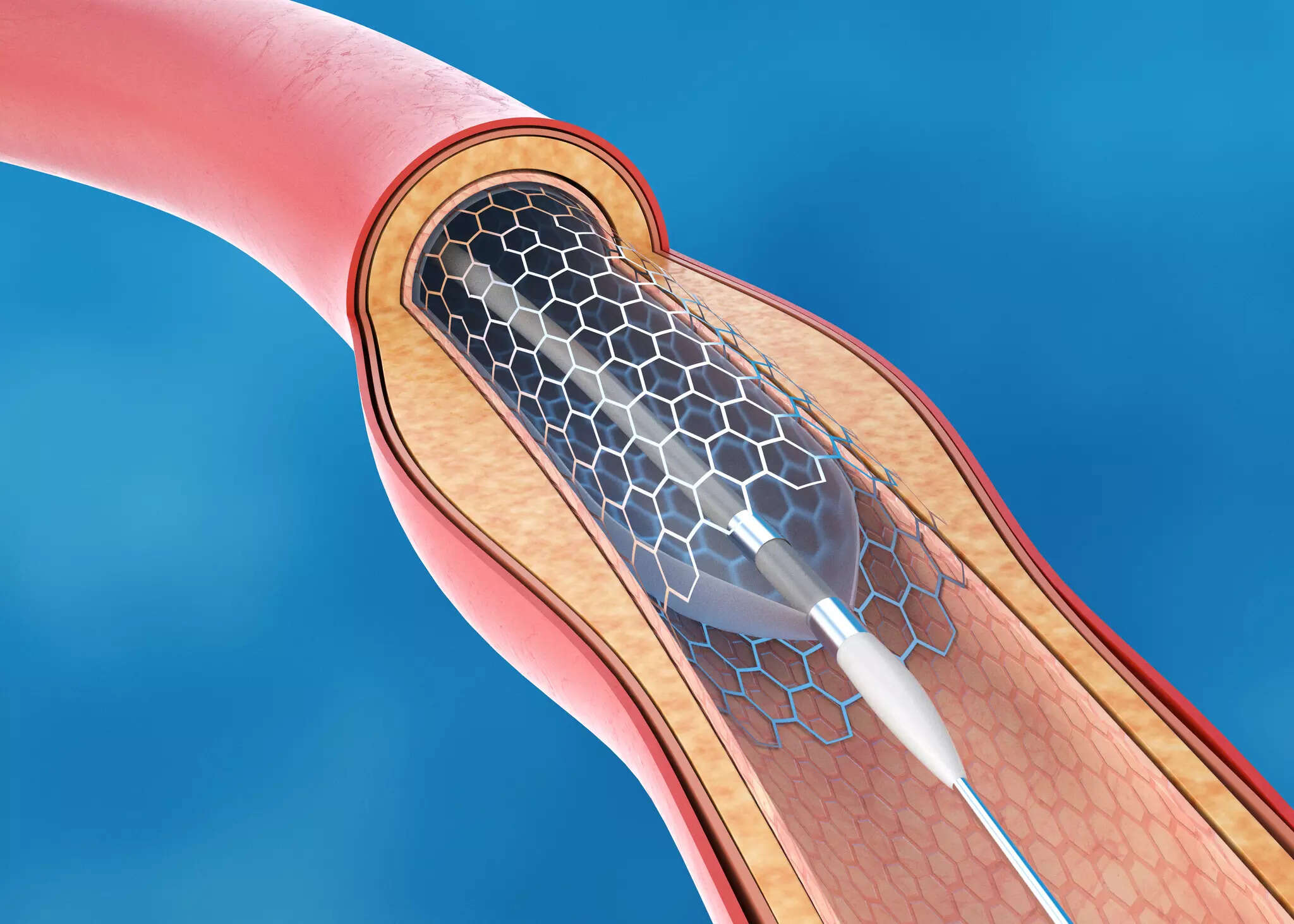

The Indian Cardiovascular devices landscape witnessed a turning point in November 2018, when the Government of India notified price control on stents, bringing down the prices by more than 80%. With a current market size of ~USD 200 million, this market is slated to be one of the fastest growing in the world, growing at a staggering 14-15% CAGR over next decade. Let’s find out what’s driving this growth.

A stent in time

Historically speaking, it’s interesting to note that India’s medical devices market was dominated by global majors. This heavy reliance on expensive imported devices hindered accessibility to life-saving interventions, with only a fraction of the population receiving essential procedures, such as percutaneous coronary interventions (PCI). However, post implementation of the price cap, there was an over 30% surge in the number of stent implants in just 12 months.

The price control combined with inclusion of stent implants in government schemes led to both a multi-fold increase in stent implants and a remarkable shift in the Indian landscape, with Indian players increasing their market share from 35% to an impressive 60%. Global majors such as Abbott Vascular, Boston Scientific, and Medtronic, had to adapt to the revised pricing, allowing local players, such as, SMT, Translumina, and Meril room to grow their share by providing high-quality products but at a much lower cost. India’s advantage in manufacturing, with low labour costs and a pool of skilled talent, further fuelled the growth of domestic production.

The Indian domestic market is now poised for much faster growth compared to its global peers due to its considerably small base versus the size of its population. Deepening insurance penetration, rising affordability and the widening of patient pool driven by government sponsored schemes are some of the key factors driving this growth. Global exports are also likely to play a critical role for domestic medical devices manufacturers, particularly those with high quality standards and in-house capabilities.

Expanding into global markets

The pricing reforms coincided with two big milestones in the Indian stent space – the successful completion of first clinical trial in India by SMT Pvt. Ltd and the launch of the first bioabsorbable stent by Meril Life Sciences.

These two episodes provided a perfect launch pad to succeed in the international markets via increased acceptability and reliability of Indian manufactured cardiology devices. This led to a successful expansion by select Indian manufacturers across global markets, including Europe, Southeast Asia, Africa and the Middle East.

Strong growth, global expansion and, rising profitability led to increased interest from financial sponsors, including Private Equity investors. This enabled Indian players to build world-class R&D and manufacturing infrastructure, while maintaining the local cost advantage. With additional capital and capabilities, select Indian manufacturers have been able to conduct expensive global trials and establish techno-commercial teams to navigate the complex regulatory and marketing processes in developed markets.

Over the last six years, most Indian stent manufacturers have seen exponential growth in international markets and have established a strong foothold in multiple countries.

Next Opportunity: Foray into the Structural Heart Devices market

While Indian players enjoyed success in stents in both domestic as well as international markets, structural heart devices market is still a nascent play for most. In recent years, many of the global CVD leaders have been shifting their focus towards structural heart devices due to significantly higher sophistication and realization. While the global structural heart devices market stood at USD 5.6 billion in 2020 and is expected to grow at 13% over the next 5 years, India’s structural heart market stands at a mere USD 12.4 million and is projected to grow at a 31% CAGR due to a very low base. In India, the limited penetration can be attributed to factors like affordability, accessibility, and a shortage of specialists capable of conducting these complex procedures.

Per our interaction with few leading clinicians, we understand that minimally invasive procedures for structural heart disease can cost up to INR 30 lakhs using MNC products and nearly half using products from Indian players. On top of this high treatment cost, this procedure is currently not reimbursed by any government schemes, thus making it out of reach for most Indians.

The success of Indian players in the stent market provides an ideal thesis for their foray into the structural heart devices market. With established distribution networks in both domestic and global markets, Indian companies can leverage their strengths to introduce new products through organic development and/or strategic acquisitions. With greater economies of scale, the cost of production could come down over time, making the devices more affordable in the domestic market, potentially leading to a virtuous cycle of increasing demand and reducing costs.

The government will have a huge role to play in expanding this market through positive interventions like covering the structural heart procedure (for co-morbidity patients) in their schemes and/or subsidising the process for the masses. This way, companies will be commercially motivated while catering to wider patient outcomes.

Ujjwal Singh, Director, Healthcare Investment Banking, Avendus Capital

(DISCLAIMER: The views expressed are solely of the author and ETHealthworld does not necessarily subscribe to it. ETHealthworld.com shall not be responsible for any damage caused to any person / organisation directly or indirectly.)

“,”next_sibling”:[{“msid”:105378828,”title”:”Wearable technology in medical market to exceed $100 billion in 2023: GlobalData”,”entity_type”:”ARTICLE”,”link”:”/news/medical-devices/wearable-technology-in-medical-market-to-exceed-100-billion-in-2023-globaldata/105378828″,”category_name”:null,”category_name_seo”:”medical-devices”}],”related_content”:[],”seoschemas”:false,”msid”:105572044,”entity_type”:”ARTICLE”,”title”:”Rise of the Indian Challengers in the Global Cardiovascular Devices Market”,”synopsis”:”The Indian domestic market is now poised for much faster growth compared to its global peers due to its considerably small base versus the size of its population. Deepening insurance penetration, rising affordability and the widening of patient pool driven by government sponsored schemes are some of the key factors driving this growth. “,”titleseo”:”medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market”,”status”:”ACTIVE”,”authors”:[],”Alttitle”:{“minfo”:””},”artag”:”ETHealthWorld”,”artdate”:”2023-11-29 05:58:12″,”lastupd”:”2023-11-29 05:58:33″,”breadcrumbTags”:[“ujjwal singh”,”meril life sciences”,”smt”,”southeast asia”,”Cardiovascular devices”,”translumina”,”percutaneous coronary interventions”,”stent implants”],”secinfo”:{“seolocation”:”medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market”}}” data-authors=”[” data-category-name=”Medical Devices” data-category_id=”159″ data-date=”2023-11-29″ data-index=”article_1″ readability=”26.66076173605″>

The Indian domestic market is now poised for much faster growth compared to its global peers due to its considerably small base versus the size of its population. Deepening insurance penetration, rising affordability and the widening of patient pool driven by government sponsored schemes are some of the key factors driving this growth.

by Ujjwal Singh

The Indian Cardiovascular devices landscape witnessed a turning point in November 2018, when the Government of India notified price control on stents, bringing down the prices by more than 80%. With a current market size of ~USD 200 million, this market is slated to be one of the fastest growing in the world, growing at a staggering 14-15% CAGR over next decade. Let’s find out what’s driving this growth.

A stent in time

Historically speaking, it’s interesting to note that India’s medical devices market was dominated by global majors. This heavy reliance on expensive imported devices hindered accessibility to life-saving interventions, with only a fraction of the population receiving essential procedures, such as percutaneous coronary interventions (PCI). However, post implementation of the price cap, there was an over 30% surge in the number of stent implants in just 12 months.

The price control combined with inclusion of stent implants in government schemes led to both a multi-fold increase in stent implants and a remarkable shift in the Indian landscape, with Indian players increasing their market share from 35% to an impressive 60%. Global majors such as Abbott Vascular, Boston Scientific, and Medtronic, had to adapt to the revised pricing, allowing local players, such as, SMT, Translumina, and Meril room to grow their share by providing high-quality products but at a much lower cost. India’s advantage in manufacturing, with low labour costs and a pool of skilled talent, further fuelled the growth of domestic production.The Indian domestic market is now poised for much faster growth compared to its global peers due to its considerably small base versus the size of its population. Deepening insurance penetration, rising affordability and the widening of patient pool driven by government sponsored schemes are some of the key factors driving this growth. Global exports are also likely to play a critical role for domestic medical devices manufacturers, particularly those with high quality standards and in-house capabilities.

Expanding into global markets

The pricing reforms coincided with two big milestones in the Indian stent space – the successful completion of first clinical trial in India by SMT Pvt. Ltd and the launch of the first bioabsorbable stent by Meril Life Sciences.

These two episodes provided a perfect launch pad to succeed in the international markets via increased acceptability and reliability of Indian manufactured cardiology devices. This led to a successful expansion by select Indian manufacturers across global markets, including Europe, Southeast Asia, Africa and the Middle East.

Strong growth, global expansion and, rising profitability led to increased interest from financial sponsors, including Private Equity investors. This enabled Indian players to build world-class R&D and manufacturing infrastructure, while maintaining the local cost advantage. With additional capital and capabilities, select Indian manufacturers have been able to conduct expensive global trials and establish techno-commercial teams to navigate the complex regulatory and marketing processes in developed markets.

Over the last six years, most Indian stent manufacturers have seen exponential growth in international markets and have established a strong foothold in multiple countries.

Next Opportunity: Foray into the Structural Heart Devices market

While Indian players enjoyed success in stents in both domestic as well as international markets, structural heart devices market is still a nascent play for most. In recent years, many of the global CVD leaders have been shifting their focus towards structural heart devices due to significantly higher sophistication and realization. While the global structural heart devices market stood at USD 5.6 billion in 2020 and is expected to grow at 13% over the next 5 years, India’s structural heart market stands at a mere USD 12.4 million and is projected to grow at a 31% CAGR due to a very low base. In India, the limited penetration can be attributed to factors like affordability, accessibility, and a shortage of specialists capable of conducting these complex procedures.

Per our interaction with few leading clinicians, we understand that minimally invasive procedures for structural heart disease can cost up to INR 30 lakhs using MNC products and nearly half using products from Indian players. On top of this high treatment cost, this procedure is currently not reimbursed by any government schemes, thus making it out of reach for most Indians.

The success of Indian players in the stent market provides an ideal thesis for their foray into the structural heart devices market. With established distribution networks in both domestic and global markets, Indian companies can leverage their strengths to introduce new products through organic development and/or strategic acquisitions. With greater economies of scale, the cost of production could come down over time, making the devices more affordable in the domestic market, potentially leading to a virtuous cycle of increasing demand and reducing costs.

The government will have a huge role to play in expanding this market through positive interventions like covering the structural heart procedure (for co-morbidity patients) in their schemes and/or subsidising the process for the masses. This way, companies will be commercially motivated while catering to wider patient outcomes.

Ujjwal Singh, Director, Healthcare Investment Banking, Avendus Capital

(DISCLAIMER: The views expressed are solely of the author and ETHealthworld does not necessarily subscribe to it. ETHealthworld.com shall not be responsible for any damage caused to any person / organisation directly or indirectly.)

<span id="etb2b-news-detail-page" class="etb2b-module-ETB2BNewsDetailPage" data-news-id="105572044" data-news="{"link":"/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044","seolocation":"/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044","seolocationalt":"/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044","seometatitle":false,"seo_meta_description":"The Indian domestic market is now poised for much faster growth compared to its global peers due to its considerably small base versus the size of its population. Deepening insurance penetration, rising affordability and the widening of patient pool driven by government sponsored schemes are some of the key factors driving this growth. ","canonical_url":false,"url_seo":"/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044","category_name":"Medical Devices","category_link":"/news/medical-devices","category_name_seo":"medical-devices","updated_at":"2023-11-29 05:58:33","artexpdate":false,"agency_name":"ETHealthWorld","agency_link":"/agency/88675629/ETHealthWorld","read_duration":"4 min","no_index_no_follow":false,"keywords":[{"id":1832783,"name":"ujjwal singh","type":"General","weightage":80,"keywordseo":"ujjwal-singh","botkeyword":false,"source":"Orion","link":"/tag/ujjwal+singh"},{"id":3727552,"name":"meril life sciences","type":"General","weightage":80,"keywordseo":"meril-life-sciences","botkeyword":false,"source":"Orion","link":"/tag/meril+life+sciences"},{"id":1715229,"name":"smt","type":"General","weightage":50,"keywordseo":"smt","botkeyword":false,"source":"Orion","link":"/tag/smt"},{"id":53564,"name":"southeast asia","type":"General","weightage":50,"keywordseo":"southeast-asia","botkeyword":false,"source":"Orion","link":"/tag/southeast+asia"},{"id":15378315,"name":"Cardiovascular devices","type":"General","weightage":20,"keywordseo":"Cardiovascular-devices","botkeyword":false,"source":"Orion","link":"/tag/cardiovascular+devices"},{"id":1069791,"name":"translumina","type":"General","weightage":20,"keywordseo":"translumina","botkeyword":false,"source":"Orion","link":"/tag/translumina"},{"id":5949510,"name":"percutaneous coronary interventions","type":"General","weightage":20,"keywordseo":"percutaneous-coronary-interventions","botkeyword":false,"source":"Orion","link":"/tag/percutaneous+coronary+interventions"},{"id":1544318,"name":"stent implants","type":"General","weightage":20,"keywordseo":"stent-implants","botkeyword":false,"source":"Orion","link":"/tag/stent+implants"}],"read_industry_leader_count":false,"read_industry_leaders":false,"embeds":[{"title":"Over the last six years, most Indian stent manufacturers have seen exponential growth in international markets and have established a strong foothold in multiple countries.","type":"image","caption":false,"elements":[]}],"thumb_big":"https://etimg.etb2bimg.com/thumb/msid-105572044,imgsize-132670,width-1200,height=765,overlay-ethealth/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market.jpg","thumb_small":"https://etimg.etb2bimg.com/thumb/img-size-132670/105572044.cms?width=150&height=112","time":"2023-11-29 05:58:12","is_live":false,"prime_id":0,"highlights":[],"highlights_html":"","also_read_available":false,"body":"

by Ujjwal Singh

The Indian Cardiovascular devices landscape witnessed a turning point in November 2018, when the Government of India notified price control on stents, bringing down the prices by more than 80%. With a current market size of ~USD 200 million, this market is slated to be one of the fastest growing in the world, growing at a staggering 14-15% CAGR over next decade. Let’s find out what’s driving this growth.

A stent in time

Historically speaking, it’s interesting to note that India’s medical devices market was dominated by global majors. This heavy reliance on expensive imported devices hindered accessibility to life-saving interventions, with only a fraction of the population receiving essential procedures, such as percutaneous coronary interventions (PCI). However, post implementation of the price cap, there was an over 30% surge in the number of stent implants in just 12 months.

The price control combined with inclusion of stent implants in government schemes led to both a multi-fold increase in stent implants and a remarkable shift in the Indian landscape, with Indian players increasing their market share from 35% to an impressive 60%. Global majors such as Abbott Vascular, Boston Scientific, and Medtronic, had to adapt to the revised pricing, allowing local players, such as, SMT, Translumina, and Meril room to grow their share by providing high-quality products but at a much lower cost. India’s advantage in manufacturing, with low labour costs and a pool of skilled talent, further fuelled the growth of domestic production.

The Indian domestic market is now poised for much faster growth compared to its global peers due to its considerably small base versus the size of its population. Deepening insurance penetration, rising affordability and the widening of patient pool driven by government sponsored schemes are some of the key factors driving this growth. Global exports are also likely to play a critical role for domestic medical devices manufacturers, particularly those with high quality standards and in-house capabilities.

Expanding into global markets

The pricing reforms coincided with two big milestones in the Indian stent space – the successful completion of first clinical trial in India by SMT Pvt. Ltd and the launch of the first bioabsorbable stent by Meril Life Sciences.

These two episodes provided a perfect launch pad to succeed in the international markets via increased acceptability and reliability of Indian manufactured cardiology devices. This led to a successful expansion by select Indian manufacturers across global markets, including Europe, Southeast Asia, Africa and the Middle East.

Strong growth, global expansion and, rising profitability led to increased interest from financial sponsors, including Private Equity investors. This enabled Indian players to build world-class R&D and manufacturing infrastructure, while maintaining the local cost advantage. With additional capital and capabilities, select Indian manufacturers have been able to conduct expensive global trials and establish techno-commercial teams to navigate the complex regulatory and marketing processes in developed markets.

Over the last six years, most Indian stent manufacturers have seen exponential growth in international markets and have established a strong foothold in multiple countries.

Next Opportunity: Foray into the Structural Heart Devices market

While Indian players enjoyed success in stents in both domestic as well as international markets, structural heart devices market is still a nascent play for most. In recent years, many of the global CVD leaders have been shifting their focus towards structural heart devices due to significantly higher sophistication and realization. While the global structural heart devices market stood at USD 5.6 billion in 2020 and is expected to grow at 13% over the next 5 years, India’s structural heart market stands at a mere USD 12.4 million and is projected to grow at a 31% CAGR due to a very low base. In India, the limited penetration can be attributed to factors like affordability, accessibility, and a shortage of specialists capable of conducting these complex procedures.

Per our interaction with few leading clinicians, we understand that minimally invasive procedures for structural heart disease can cost up to INR 30 lakhs using MNC products and nearly half using products from Indian players. On top of this high treatment cost, this procedure is currently not reimbursed by any government schemes, thus making it out of reach for most Indians.

The success of Indian players in the stent market provides an ideal thesis for their foray into the structural heart devices market. With established distribution networks in both domestic and global markets, Indian companies can leverage their strengths to introduce new products through organic development and/or strategic acquisitions. With greater economies of scale, the cost of production could come down over time, making the devices more affordable in the domestic market, potentially leading to a virtuous cycle of increasing demand and reducing costs.

The government will have a huge role to play in expanding this market through positive interventions like covering the structural heart procedure (for co-morbidity patients) in their schemes and/or subsidising the process for the masses. This way, companies will be commercially motivated while catering to wider patient outcomes.

Ujjwal Singh, Director, Healthcare Investment Banking, Avendus Capital

(DISCLAIMER: The views expressed are solely of the author and ETHealthworld does not necessarily subscribe to it. ETHealthworld.com shall not be responsible for any damage caused to any person / organisation directly or indirectly.)

“,”next_sibling”:[{“msid”:105378828,”title”:”Wearable technology in medical market to exceed $100 billion in 2023: GlobalData”,”entity_type”:”ARTICLE”,”link”:”/news/medical-devices/wearable-technology-in-medical-market-to-exceed-100-billion-in-2023-globaldata/105378828″,”category_name”:null,”category_name_seo”:”medical-devices”}],”related_content”:[],”seoschemas”:false,”msid”:105572044,”entity_type”:”ARTICLE”,”title”:”Rise of the Indian Challengers in the Global Cardiovascular Devices Market”,”synopsis”:”The Indian domestic market is now poised for much faster growth compared to its global peers due to its considerably small base versus the size of its population. Deepening insurance penetration, rising affordability and the widening of patient pool driven by government sponsored schemes are some of the key factors driving this growth. “,”titleseo”:”medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market”,”status”:”ACTIVE”,”authors”:[],”Alttitle”:{“minfo”:””},”artag”:”ETHealthWorld”,”artdate”:”2023-11-29 05:58:12″,”lastupd”:”2023-11-29 05:58:33″,”breadcrumbTags”:[“ujjwal singh”,”meril life sciences”,”smt”,”southeast asia”,”Cardiovascular devices”,”translumina”,”percutaneous coronary interventions”,”stent implants”],”secinfo”:{“seolocation”:”medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market”}}” data-news_link=”https://health.economictimes.indiatimes.com/news/medical-devices/rise-of-the-indian-challengers-in-the-global-cardiovascular-devices-market/105572044″>

<!– –>

<!– "logo": "”, –>